Related searches

Mortgage Companies Near Me

Rocket Mortgage Home Equity Loan

Apply For Mortgage Loan

Mortgage Loan Rates

Mortgage Loan Refinance

Mortgage Lenders

Mortgage Lenders

Choosing the right mortgage lender is one of the most important steps in your homebuying or refinancing journey. Whether you prefer a local bank, a credit union, or an online lender, it’s essential to work with a reputable company that offers competitive rates and excellent customer service. Take the time to compare lenders, read reviews, and ask for recommendations to find the best fit for your needs.

Mortgage Loan Rates

Your interest rate plays a huge role in determining your monthly payments and the overall cost of your loan. That’s why it’s crucial to shop around for the best mortgage loan rates. Even a small difference in rates can save you thousands of dollars over the life of your loan. Keep an eye on market trends and lock in a low rate when the time is right!

Mortgage Companies Near Me

If you prefer a more personalized experience, working with local mortgage companies near you can be a great option. Local lenders often have a deep understanding of the housing market in your area and can provide tailored advice and support. Plus, meeting face-to-face can make the process feel more transparent and trustworthy.

Apply For Mortgage Loan

Ready to take the next step? Applying for a mortgage loan is easier than ever, thanks to online tools and streamlined processes. Most lenders allow you to pre-qualify online, giving you an estimate of how much you can borrow without impacting your credit score. Once you’re ready, gather your financial documents and submit your application to get approved quickly.

Rocket Mortgage Home Equity Loan

Looking to access your home’s equity for renovations, debt consolidation, or other expenses? Rocket Mortgage offers convenient and competitive home equity loan options. With their user-friendly online platform, you can explore your equity options, check rates, and apply in just a few clicks. It’s a fast and easy way to unlock the value of your home!

Mortgage Loan Refinance

Refinancing your mortgage can help you save money, lower your monthly payments, or even shorten your loan term. Whether you’re looking to take advantage of lower interest rates or switch from an adjustable-rate to a fixed-rate mortgage, mortgage loan refinance options are worth exploring. Compare lenders to find the best refinance rates and terms for your financial goals.

Why Wait? Start Your Mortgage Journey Today!

Your dream home or financial freedom is just a few steps away. Whether you’re buying, refinancing, or tapping into your equity, now is the perfect time to explore your options and take action.

The Current State and Analysis of Credit Card Installment PaymentsCredit card installment payments are popular payment option. That allows consumers to spread the cost of purchases over several months. This payment method has become increasingly prevalent in recent years, with more and more consumers opting to use it for larger purchases. However, there are both benefits and drawbacks to using credit card installment payments

The Current State and Analysis of Credit Card Installment PaymentsCredit card installment payments are popular payment option. That allows consumers to spread the cost of purchases over several months. This payment method has become increasingly prevalent in recent years, with more and more consumers opting to use it for larger purchases. However, there are both benefits and drawbacks to using credit card installment payments How to Secure Funding When You Need It Most: A Guide to Business Grants and Financial SupportStarting a business or maintaining one can be challenging, especially when you’re struggling financially. You might find yourself thinking, “I’m poor and need money,” and wondering where to turn for help. Fortunately, there are several options available, including business grants, that can provide the necessary funding to get your venture off the ground or keep it afloat.

How to Secure Funding When You Need It Most: A Guide to Business Grants and Financial SupportStarting a business or maintaining one can be challenging, especially when you’re struggling financially. You might find yourself thinking, “I’m poor and need money,” and wondering where to turn for help. Fortunately, there are several options available, including business grants, that can provide the necessary funding to get your venture off the ground or keep it afloat. How to Secure Free Grants and Funding to Start Your Small BusinessStarting a small business can be an exciting yet financially challenging journey. Fortunately, there are numerous business grants and funding opportunities available to help aspiring entrepreneurs achieve their goals without taking on debt. In this article, we’ll explore different ways to access free money to start a small business, how to qualify for a grant, and provide some tips for those facing financial hardships.

How to Secure Free Grants and Funding to Start Your Small BusinessStarting a small business can be an exciting yet financially challenging journey. Fortunately, there are numerous business grants and funding opportunities available to help aspiring entrepreneurs achieve their goals without taking on debt. In this article, we’ll explore different ways to access free money to start a small business, how to qualify for a grant, and provide some tips for those facing financial hardships.

Top 10 Credit Cards in the UK: Find Your Perfect MatchDiscover the best credit cards in the UK that cater to every lifestyle! Whether you're looking for rewards, low interest rates, or special perks, our comprehensive guide covers the top contenders in the market. Ready to find your perfect financial companion? Click on the links below to explore each option in detail!

Top 10 Credit Cards in the UK: Find Your Perfect MatchDiscover the best credit cards in the UK that cater to every lifestyle! Whether you're looking for rewards, low interest rates, or special perks, our comprehensive guide covers the top contenders in the market. Ready to find your perfect financial companion? Click on the links below to explore each option in detail! Discover the Best Small Business Loans: Your Guide to Easy Approval and Low RatesSecuring the right funding is crucial for the success and growth of any small business. Whether you're just starting out or looking to expand, finding the best small business loans with favorable terms can be the key to unlocking your business's potential. Here’s everything you need to know about obtaining small business loans, even if you have bad credit.

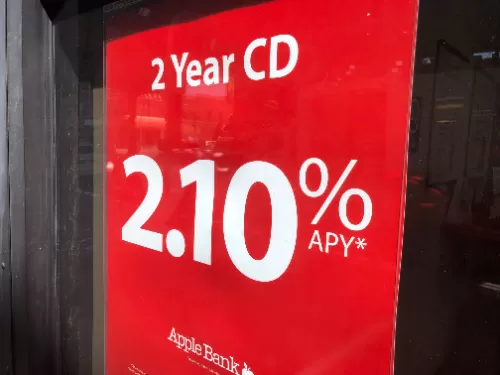

Discover the Best Small Business Loans: Your Guide to Easy Approval and Low RatesSecuring the right funding is crucial for the success and growth of any small business. Whether you're just starting out or looking to expand, finding the best small business loans with favorable terms can be the key to unlocking your business's potential. Here’s everything you need to know about obtaining small business loans, even if you have bad credit. Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Navigating the Terrain of CD Rates: A Guide to Maximizing Your SavingsIn the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money. Unlock Your Potential: Apply for Government Small Business Grants TodayStarting or expanding a small business can be a challenging journey, but government small business grants offer an incredible opportunity to fuel your dreams. These grants provide a financial boost without the burden of repayment, allowing you to focus on growing your business. In this guide, we’ll explore various options and how you can secure the funding you need.

Unlock Your Potential: Apply for Government Small Business Grants TodayStarting or expanding a small business can be a challenging journey, but government small business grants offer an incredible opportunity to fuel your dreams. These grants provide a financial boost without the burden of repayment, allowing you to focus on growing your business. In this guide, we’ll explore various options and how you can secure the funding you need.